Scammers continue to exploit commonly used communication channels to target

victims. They pose as trusted entities, individuals, or businesses to deceive unsuspecting

victims. These fraudsters impersonate government officials, pose as family members in danger,

and even pretend to be bank or credit union employees.

Common Texts Sent by Fraudsters

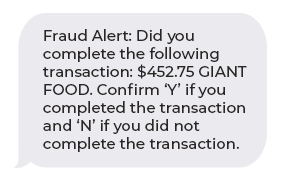

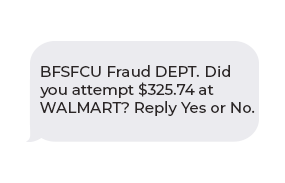

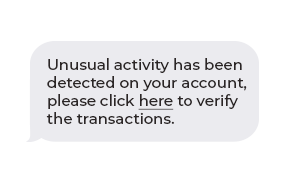

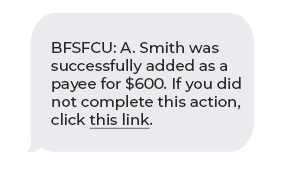

A recently emerging scam involves initiating contact through text messages, where the fraudsters pretend to be representatives from a bank or credit union's fraud department. The messages will usually cite suspicious or concerning activity and may resemble the following:

These text messages are often crafted to manipulate the recipient

into taking a specific action, such as confirming a transaction or clicking on a malicious

link. The goal is to engage the victim and convince them to follow fraudulent

instructions.

If a phone call is answered, scammers will impersonate bank personnel, claiming to be from the "fraud or security department." They will appear as if they are there to help but, in truth, their intentions are to obtain access to online banking accounts. They do this by seeking login details, such as usernames and passwords, gathering personal identification data and account numbers, or persuading victims to make payments to rectify an alleged "issue."

Be prudent when answering a call from an unknown entity, person,

or company, especially following a suspicious text message. If you are asked for any of the

following information, STOP and hang up.

BFSFCU Staff will never ask for the

following:

- Digital Banking remote access

- Username for Digital Banking

- Password for Digital Banking

- Social Security Numbers (in entirety)

- One-time passcodes

- To download any app or software so that you can share your screen

- Debit or Credit Card PIN numbers

- Full Debit or Credit Card numbers

- Mother’s maiden name, street you grew up on, or any other security related questions and answers

Tips to Prevent Text Scams

Fraudsters convince people to provide these sensitive pieces of information under the guise of helping to solve the issue or concern. The following tips can help you avoid becoming a victim of a Text Scam:

- Always be wary of any caller, even if you recognize the Caller ID. Fraudsters can spoof bank and financial institution contact numbers to appear legitimate. If you think it is your bank calling, find contact information through the bank’s legitimate website. For BFSFCU, contact information is found at Contact Us: Additionally, sending a secure message through Digital Banking is another option.

- Fraudsters instill a sense of urgency by convincing you there is a problem that must be resolved immediately. Stop, take a minute, and think through what is being asked of you. Financial institutions will never pressure you into taking immediate action.

- Never use the phone number provided in the text message or email to call. If you need to contact your bank, always go through the phone number listed on their official website.

- Pay attention to the grammar and spelling of the text messages. Scammers will often be quick to send messages and they may contain spelling errors.

Learn to block and report unwanted texts:

How To Block Unwanted Calls | Consumer Advice (ftc.gov)

How to Recognize and Report Spam Text Messages | Consumer Advice (ftc.gov)