Checking Accounts

Checking account options to meet your needs.

Keep it simple, or simply earn more. Either way, enjoy fast and easy access to your money with our digital banking, mobile check deposit, and a network of over 30,000 fee-free ATMs nationwide.

Membership Checking

Simple

and straightforward.

Money Management Checking

Putting your money to

work for you.

Premier Checking

Enjoy higher dividends when you achieve Global Rewards PLUS or OPTIMUM levels!

Open or upgrade to Premier Checking Account

OPEN

Log in to Digital Banking

Click on Self Service menu

Select Account Opening

UPGRADE

Log in to Digital Banking

Click on Self Service menu

Send a Secure Message

Convenient, Full-Service ATM Locations

Check your balances, withdraw cash and transfer money for free at over 30,000 ATMs nationwide. Use any ATM within the Co-Op or Alliance Networks for fee-free transactions. Use our ATM locator to find the one nearest you.

Save Time with BFSFCU Mobile Deposit

Deposit checks from anywhere using BFSFCU’s Digital Banking App. Simply endorse the back of the check

and write “For BFSFCU Mobile Deposit only,” then follow the instructions in our Digital Banking app to proceed with the deposit.

Learn More

Get MORE out of your BFSFCU Relationship

With our Global Rewards program you can enjoy more benefits on your everyday banking, including ATM transaction fee rebates.

The bigger your relationship with us, the higher the rewards.

Our Global Rewards program features three levels of ATM surcharge rebates:

- CHOICE level – up to $5 per month

- PLUS level – up to $20 per month

- OPTIMUM level – Unlimited

ATM rebates are just the beginning of the many valuable benefits that come with our Global Rewards program. Visit our Global Rewards page to learn more, or log in to Digital Banking to find out which rewards you qualify for.

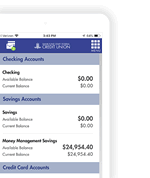

Manage your BFSFCU Accounts Wherever You Go

Log in or enroll

now to enjoy the benefits of Digital Banking, including:

-

View balances and transactions

-

Make deposits

-

Transfer money

-

Make credit card payments

-

Locate nearby surcharge-free ATMs