Savings Accounts

Your savings are safe with a credit union you can trust.

Save Faster, Save Better

Vacation, a new home, college funds, or retirement—whatever you’re saving for, our savings accounts give you a safe and easy way to grow your money while keeping it available.

Money

Management Savings

The higher your balance, the higher your savings rate.

- Enjoy money market rates based on a tiered structure

- Dividends are calculated on the balance in the account at the end of each day and are compounded and paid monthly

- No minimum balance requirement to open the account, however a $2,500 minimum balance is required to earn dividends

Savings

Our Savings Account may be just what you need to start saving today.

- No account

maintenance fees - No minimum balance requirements to open or earn dividends

- Dividends are paid and compounded quarterly

How much can I save over time?

Your Savings are Safe

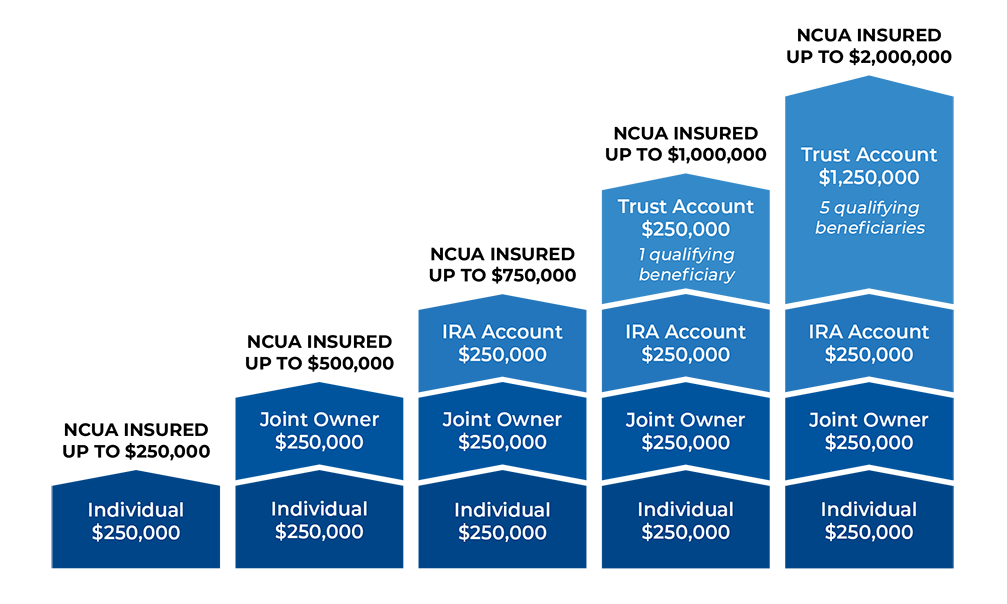

Your savings are insured by the NCUA (National Credit Union Administration), an agency of the federal government, and the administrator of the NCUSIF (National Credit Union Share Insurance Fund). Your savings are protected up to at least $250,000 per individual depositor, or it could be more based on account ownership and structure. Visit our NCUA Share Insurance page to learn more.

Manage your BankFund Accounts Wherever You Go

Log in or enroll

now to enjoy the benefits of Digital Banking, including:

-

View balances and transactions

-

Make deposits

-

Transfer money

-

Make credit card payments

-

Locate nearby surcharge-free ATMs